News

Statement by New York State AFL-CIO President Mario Cilento on the Passage of the Big Ugly Betrayal

News

Statement by New York State AFL-CIO President Mario Cilento on the Passage of the Big Ugly Betrayal

Statement by New York State AFL-CIO President Mario Cilento on the Passage of the Big Ugly Betrayal

WATCH: New York State Reconciliation Fight Back Call (June 25, 2025)

News

WATCH: New York State Reconciliation Fight Back Call (June 25, 2025)

WATCH: New York State Reconciliation Fight Back Call (June 25, 2025)

Union Strong Episode 115: The Big Beautiful Betrayal

News

Union Strong Episode 115: The Big Beautiful Betrayal

Union Strong Episode 115: The Big Beautiful Betrayal

Recent

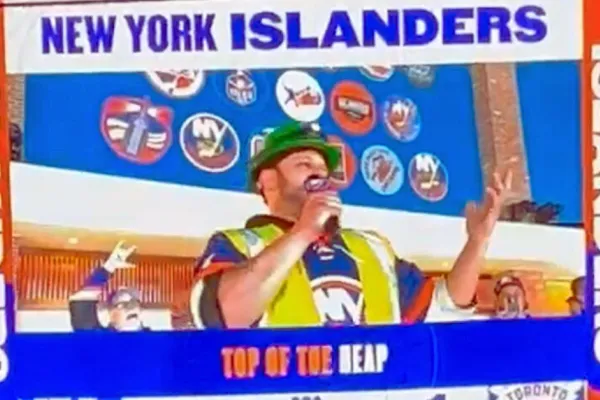

Union Strong Episode 103: The Singing Electrician

Union Strong Episode 102: Union Strong in Buffalo New York

New York Mets to Host Union Strong Night Labor Day Weekend 2023

President Mario Cilento on Picket Line with SAG-AFTRA for a Fair Contract!

The NYS AFL-CIO Stands With IBEW Local 3 Workers On Strike At WESCO